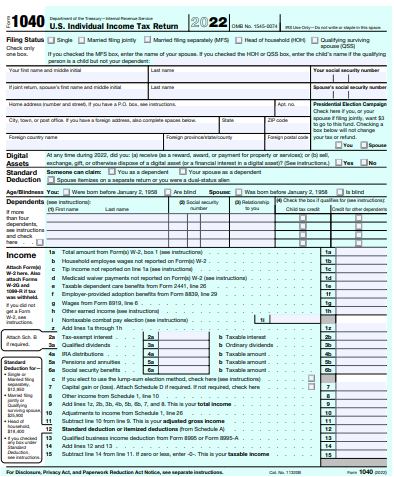

2024 Irs Form 1040 Schedule 4 – The IRS has adjusted federal income tax bracket ranges for the 2024 tax year to account for inflation. Here’s what you need to know. . Although the date for filing your tax return for 2024 is a long way off, smart taxpayers will start thinking about that return far in advance. Proper tax planning takes time, so it’s actually wise to .

2024 Irs Form 1040 Schedule 4

Source : www.incometaxgujarat.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

IRS program will allow taxpayers in 13 states to file for free in

Source : www.al.com

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

What is IRS Form 1040 Schedule 4? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

LifeCycle Tax and Wealth Management | Pensacola FL

Source : m.facebook.com

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

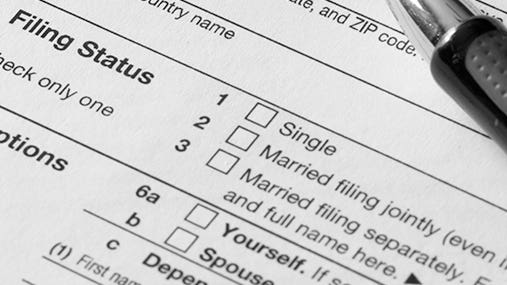

2024 Irs Form 1040 Schedule 4 Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D : 4. Choose a Filing Status deduction or itemize your deductions on Schedule A. Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for . THE IRS SAYS THE SEVEN TAX BRACKETS ARE BEING RAISED FOR THE 2024 FILING SEASON BY 5.4%. A SLIGHT DROP FROM THE PREVIOUS YEAR’S INCREASE OF 7%. IF YOU’VE GOT A BIG RAISE, IF YOU’VE GOT A NEW .